Nigerian fintech start-up Rise has expanded its footprint into East Africa by acquiring Kenyan investment platform Hisa.

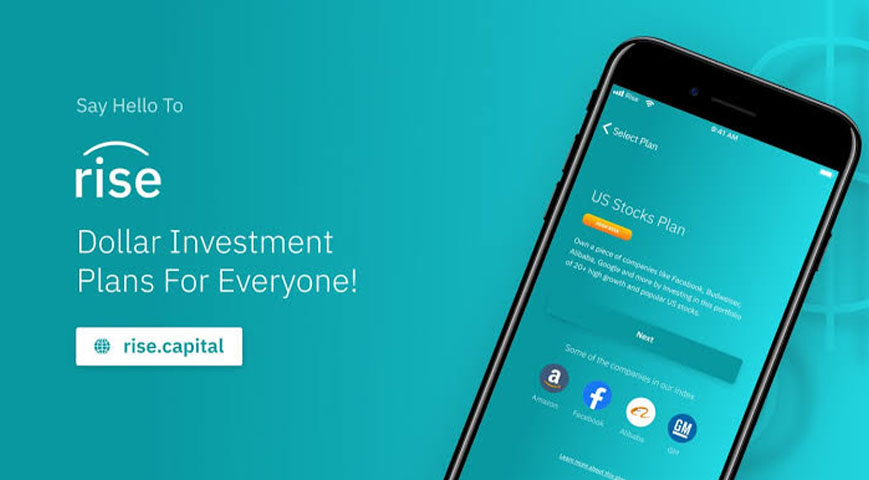

Rise specializes in offering global stock investments in US dollar-denominated securities and aims to provide users with access to international stock markets.

On the other hand, Hisa enables Africans to make borderless investments in local and global stocks, ETFs, bonds, and alternative investments.

Kenya’s Capital Markets Authority (CMA) approved the acquisition, allowing Hisa to retain its brand, operations, and staff.

According to TechCabal, Rise’s CEO, Eke Urum, mentioned that the company plans to preserve Hisa’s name due to its strong resonance with the Kenyan market. Urum emphasized the importance of understanding the new market, culture, and business environment before significantly changing Hisa's operations.

Hisa was co-founded in 2020 by Eric Jackson and Eric Asuma, who also established the digital news outlet Kenya Wall Street. The startup previously raised $250,000 in pre-seed funding and achieved a post-money valuation of $5 million.

Following the acquisition, Jackson will become the Chief Technology Officer (CTO), while Asuma, who stepped down earlier, will now serve as a strategy advisor.

This deal marks Rise's second acquisition in less than a year, following its purchase of the Nigerian digital trading platform Chaka in September 2023. Rise currently serves over 620,000 users across its platform and Chaka.

Kenya’s digital investment market is poised for significant growth, with Statista projecting total transaction values to reach $2.77 billion by 2024.

This acquisition positions Rise to tap into the fast-growing fintech sector in East Africa, further expanding its reach and influence in the region.