According to a recent study, lenders who use the Tala app say their quality of life has generally improved.

According to the most recent Tala Impact Report, 84 per cent of Kenyans have seen changes in their life due to the loan.

Good feedback comes as Kenyans struggle to overcome economic obstacles made worse by the Covid-19 outbreak and high prices.

The director of Tala Growth, Annstella Mumbi, stated, "These findings reinforce our main aim to bring the financially underserved Kenyan majority into the financial ecosystem and enable them access to affordable credit and flexible payment alternatives."

Did you read this?

"We are particularly encouraged by figures showing that 85% of our female borrowers reported a rise in their self-confidence and ability, and 60% of them claimed women now participate in household decision-making as a result of being financially able. At Tala, it is what really matters," Mumbi said.

Also, despite the high cost of living, 44% of the respondents claimed that their culture of saving had improved, giving borrowers a sense of increased control and decreased financial stress.

The poll done by the tech-enabled impact measurement business was 60 Decibels.

Eight out of ten borrowers (27%) said they had better access to credit, 23% said they could pay their bills and buy groceries, and 18% said they could buy stocks for their firms.

Tala's General Manager, Munyi Nthigah, said, "At Tala, customers are co-creators of our products, and their interests always sit at the heart of our decision-making. Therefore, with these findings, our work is more precise now than ever as our customers have spoken about what they need to improve and what is most important to them".

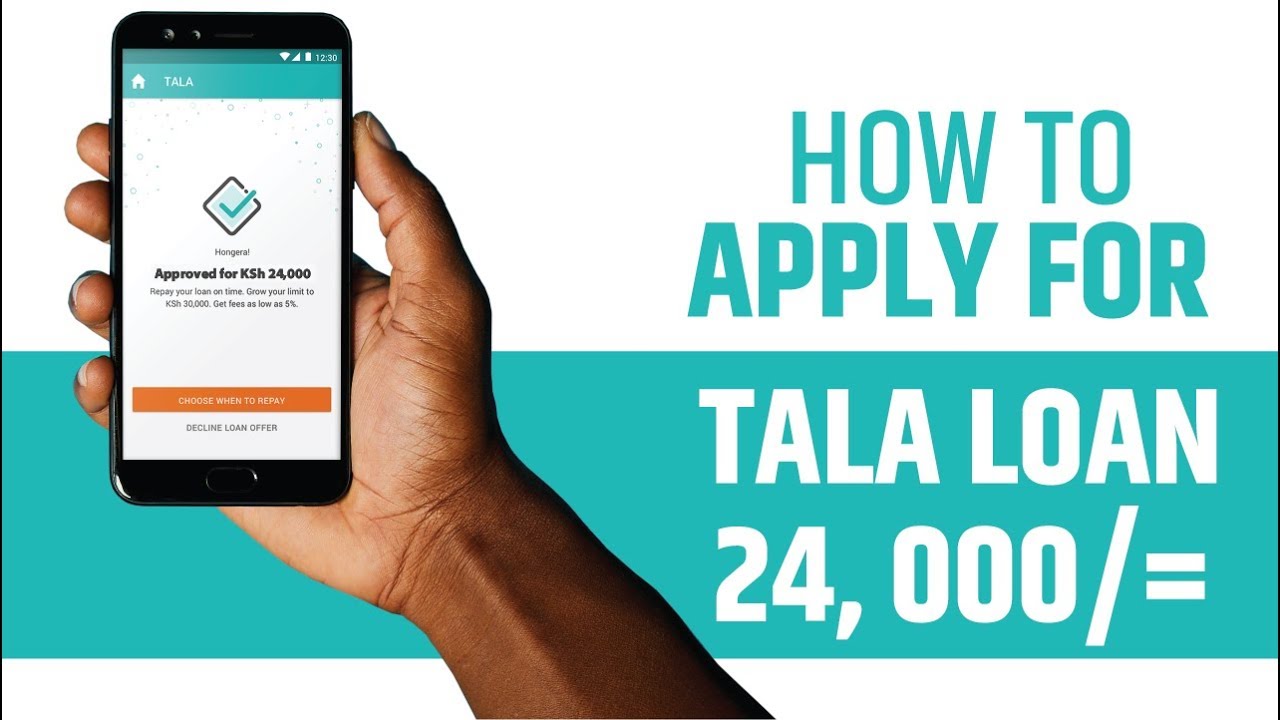

According to Tala's recently issued Money March 2022 Report, loan limits have risen from Sh30,00 to Sh50,000, and 78% of borrowers used their loans to cover business expenses, buy more stock, or finance side jobs.