The government has backdated the compulsory Housing Levy contribution proposed in the Finance Act 2023 to July 1.

This follows the lifting of the conservatory order suspending the implementation of the Finance Act by the Court of Appeal last week.

Justices Mohamed Warsame, Kathurima M’inoti and Hedwig Omondi observed that there will be irreversible economic consequences if the order is not lifted.

However, the bench allowed the appeal by Okiya Omtatah, saying it has merit but cannot suspend the implementation of the Finance Act indefinitely, given the effects it will have on taxation and government spending.

In their ruling, the judges, however, said all the parties shall abide by the final outcome of the appeal.

Did you read this?

Chief Justice(CJ) Martha Koome appointed three judges to hear and determine petitions challenging the implementation of the Finance Act 2023.

The appointed judges include High Court Judge David Majanja (presiding judge), Lady Justice Christine Meoli and Justice Lawrence Mugamb.

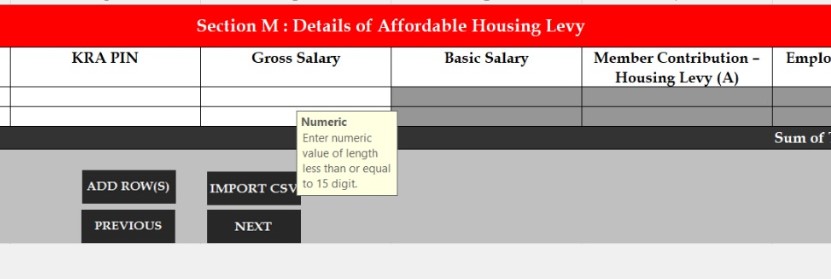

A public notice by the Ministry says the levy is payable by the employee and employer at a rate of one point five per cent of the employee’s gross monthly salary and one point five per cent of the employee’s monthly gross salary by the employer.

This translates to high-income earners of more than Kes 500,000 a month being charged tax at 32.5 per cent for monies up to Kes 800,000, while those above Kes 800,000 will be charged 35 per cent on the extra cash.

The government has appointed the Kenya Revenue Authority as the collection agent.