A Nakuru doctor, Magare Gikenyi, has filed a petition challenging sections of the Income Tax Act to exempt some people and institutions from paying tax.

Gikenyi says Sections 3(2) of the Income Tax Act Cap 470 leaves out other persons contrary to Constitutional principles, which state that the tax burden should be shared fairly by all Kenyans and by all sectors of the economy.

The medic who wants churches included in paying tax said Article 201(b) of the Constitution makes it mandatory that the taxation burden should be shared fairly.

Further, he termed Section 13 of the Income Tax Act as discriminatory and contradictory to the Constitution because it allowed certain groups of individuals and entities to be legally exempted by the statute.

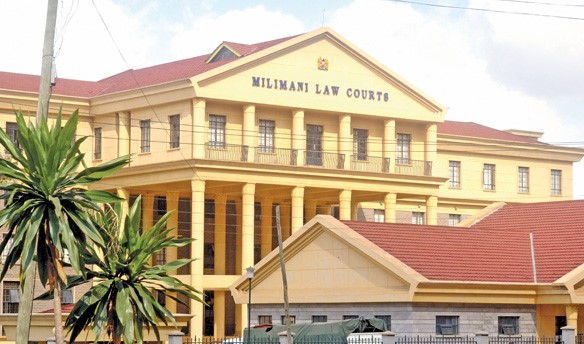

Gikenyi said that certain wealthy individuals, donor organizations, churches, mosques, temples, and specific non-governmental organizations greatly profited from the exemption in the case before the High Court in Nairobi.

Did you read this?

In this case, the Attorney General, the Cabinet Secretary for Treasury and Economic Planning, the Kenya Revenue Authority, the Senate, and the National Assembly are the respondents.

The interested parties include the Kenya Conference of Catholic Bishops, the Evangelical Alliance of Kenya, the Supreme Council of Kenya Muslims, and the National Council of Churches of Kenya.

”Tithes, offering and donations and any other person and entity exempted from taxation should be subjected to the same because article 201 of the constitution does not anticipate discrimination,” he said.

He observed that the haphazard discrimination of not sharing the tax burden to everyone increased the strain on taxpayers.

Additionally, he wants Section 13, as read with the first schedule of Income Tax Act (ITA) cap 470, declared unconstitutional as far as it purports to exempt persons or groups of persons from paying income tax.

He asked the court to declare Section 3(2) of the Income Tax Act (ITA) Cap 470 of the laws of Kenya discriminatory, unconstitutional, null, and void because it segregates and provides certain people and entities to pay income tax while leaving out others.

The doctor also sought orders barring the government from effecting any Act which purports to exempt any person and or entity from paying income tax.