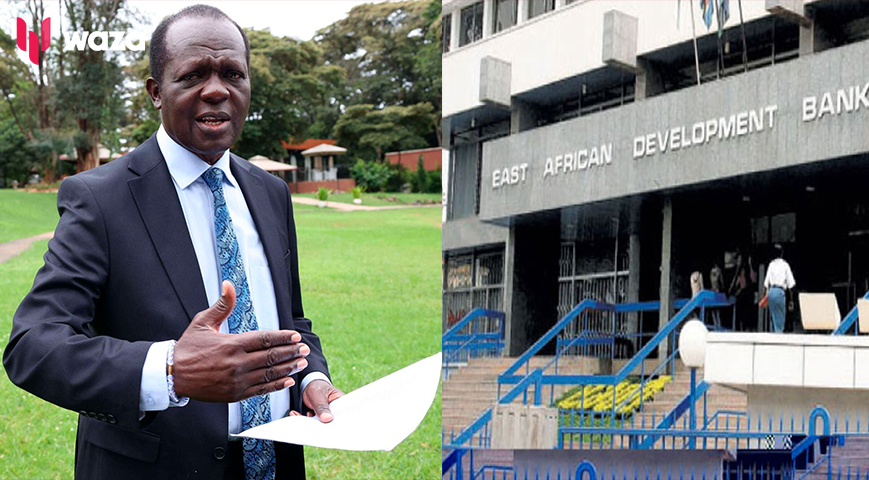

An East African Development Bank (EADB) official admitted on Wednesday that the bank failed to fulfill a Sh294 million agreement with former Cabinet Secretary Raphael Tuju. This admission came during questioning over alleged inconsistencies in statements made about a disputed Sh2.2 billion loan granted to Tuju.

Washington Odongo, the EADB official, provided conflicting accounts: in one affidavit, he claimed the loan to Tuju was disbursed in a single phase, while in another statement to the Directorate of Criminal Investigations (DCI), he stated it was a two-phase loan. The loan was intended for constructing a Sh100 million two-storey, flat-roofed bungalow and purchasing a 94-year-old bungalow built by a Scottish missionary, which now operates as a high-end restaurant.

In a statement to the DCI, Odongo confirmed that the first tranche of the facility, totaling nine million dollars, was provided for land acquisition. The second phase, meant to cover Sh294 million for the rehabilitation of existing structures and the construction of villas, was not disbursed.

Odongo explained to the court that the affidavits were prepared by the bank's legal team, and he signed them based on their guidance and assurance. "I trusted the guidance and opinion of the bank's counsel to assure me I was signing in good faith," he said.

Did you read this?

His statements align with Tuju's assertion that while $9.1 million was provided for property acquisition, the Sh294 million meant for constructing high-end residential units for sale was never disbursed. Tuju argued that the sale of these units would have repaid the loan.

Tuju also referenced a further witness statement to the DCI that supports his claims about the nature of the facility agreement and the history of interactions between the parties. In June of this year, the court permitted questioning of the bank official to scrutinize the accuracy of the statements made.

Odongo is scheduled to return to court on July 31 to conclude his testimony. The case involves a written facility agreement between Tuju and the bank, dated April 4, 2015. According to the agreement, the bank agreed to provide a $9.3 million loan to partially fund the acquisition and development of commercial units for sale in Nairobi. Tuju maintains that the bank did not fulfill the entire agreement.