Nairobi Securities Exchange (NSE) has launched a series of bond reforms to boost the growth of the country’s capital markets.

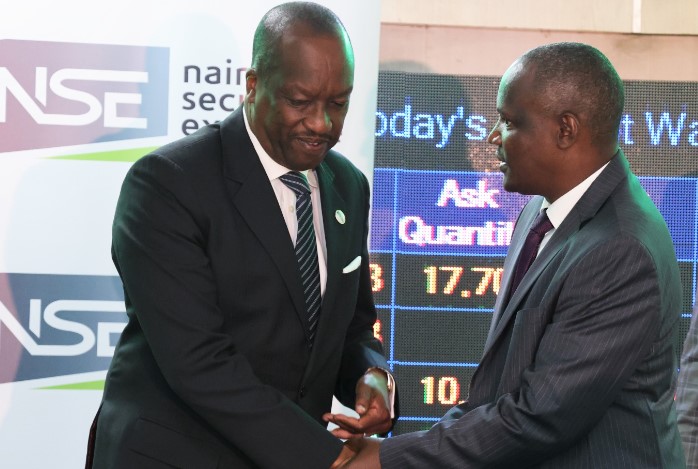

Speaking in Nairobi, National Treasury and Economic Planning Cabinet Secretary (CS) John Mbadi said introducing a hybrid fixed-income market, which will enable the NSE to offer a secondary market combining both onscreen and over-the-counter trading of fixed-income securities, is key.

“The development will allow a wider pool of licensed financial institutions including trading participants and commercial banks access to the NSE on behalf of their clients.”

Further, he stated that the hybrid fixed-income market would enhance liquidity in the capital markets by increasing pre-trade transparency and providing multiple avenues for trade execution.

He also highlighted the launch of a real-time daily yield curve, which incorporates the activities of the Quotations Board and executed trades. He noted that it will serve as a key indicator of market sentiment, guiding investment strategies.

Did you read this?