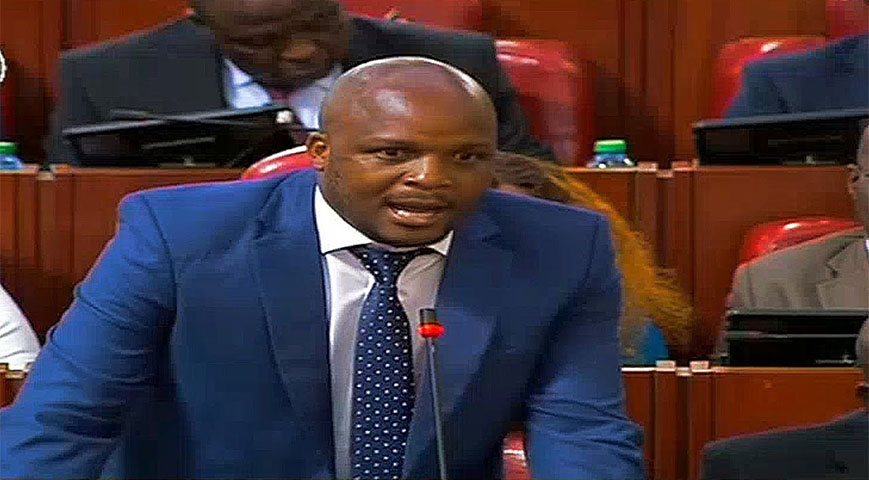

Lang'ata MP Phelix 'Jalang'o' Odiwuor has unveiled plans to introduce the Motor Insurance Bill 2024, aiming to address systemic flaws in Kenya's motor insurance industry.

Scheduled for tabling in February 2025 after Parliament resumes, the Bill seeks to eliminate compulsory motor insurance while holding insurance companies accountable for their policies.

Jalang’o criticized the current system, stating that many Kenyans pay premiums but rarely receive fair compensation after accidents.

He highlighted the role of claims officers in frustrating payouts and the burdensome excess fees imposed on policyholders.

Did you read this?

“Thousands of Kenyans wait endlessly for accident claims. Claims officers are employed to ensure you don’t get paid, and if you do, it’s never the full amount,” said the MP in a video shared on Instagram.

The MP also criticized third-party insurance, which is widely used but offers minimal protection. He noted that most Kenyans opt for it to avoid police penalties rather than for genuine coverage, labeling it as ineffective.

The proposed Bill will compel insurers to honor their agreements, particularly for comprehensive cover holders. It mandates full payouts for accidents and suggests a refund of up to 50% of premiums for policyholders who make no claims within a policy year.

Jalang’o argued this would push insurers to become more competitive and transparent, ensuring better service for vehicle owners.

“This Bill will revolutionize motor insurance in Kenya. Insurers will have to step up, start paying claims, and treat policyholders fairly,” he added.

If passed, the Motor Insurance Bill 2024 promises a significant shift in the relationship between vehicle owners and insurance companies, enhancing trust and efficiency in the industry.