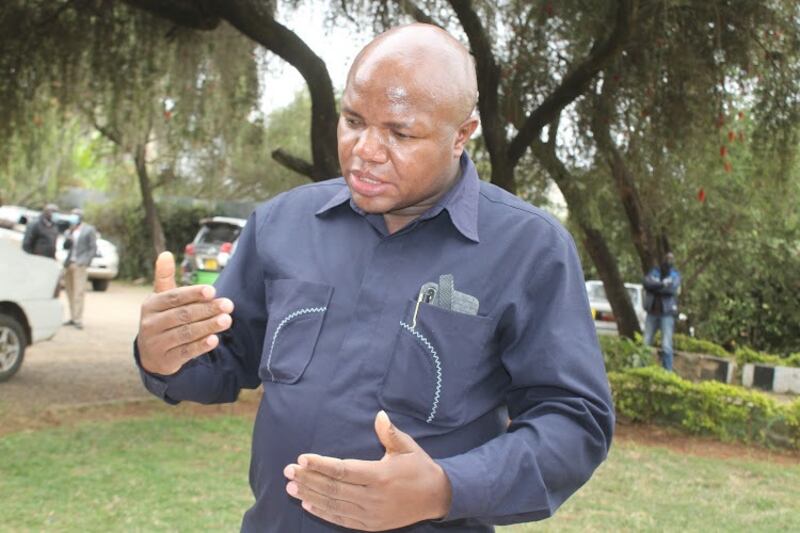

Francis Mwangangi, Deputy Governor of Machakos, says he is okay with paying up to 70% of his salary in taxes as long as it is put to good use.

"I have no problem paying up to 60-70 per cent (taxes) as long as the money goes to the right place, such as basic education." "We need to make sure that our taxes are properly handled and that Kenyans understand where these taxes are going," Mwangangi said in an interview with Citizen TV on Thursday morning.

He referred to the contentious Finance Bill 2023, which aims to amend the Employment Act by enabling 3% deductions from employees' basic salary to help fund President William Ruto's ambitious plan to create low-cost housing.

According to Machakos County's second-in-command, Kenyans are overburdened by the current tax regimes. The national and county governments must streamline their collection modules to avoid putting more strain on Kenyans.

Did you read this?

"I believe there is a challenge when the national government takes 52% of Kenyans' income and then there is taxation from county governments." "We need to have a conversation and come to an agreement at some point so that the two levels of government can meet somewhere," Mwangangi added.

In addition, the Finance Bill 2023 proposes a 15% withholding tax on payments related to the monetisation of digital content, which will impact the income of artists who make a career by creating digital content.

The measure also proposes a tax on human hair, eyelashes, switches, and fake nails to increase money from the cosmetics business.

Trade unions have already pledged to strike if the bill's proposed taxes are implemented.

They want MPs to vote against the ideas and have asked the administration to include labour unions in discussions about the best path ahead.