The recent decision by the current regime to introduce a value-added tax on bread has sparked a new political discussion. This development comes at a time when Kenyans are resisting additional taxes on essential commodities, fearing they will lead to inflation.

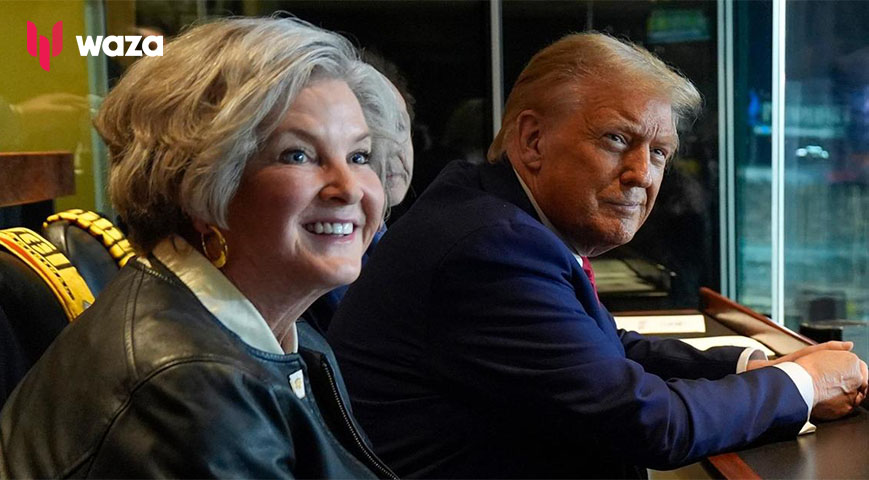

Kuria Kimani, the outspoken Member of Parliament for Molo constituency, has shed light on the reasoning behind taxing bread. He emphasized that the National Treasury highlighted concerns about diabetes, largely attributed to bread consumption.

The tax is aimed at raising the price of bread to deter consumption among many Kenyans, thus reducing diabetes cases in the country. Contrary to popular belief, the objective is not solely to collect taxes from citizens, but rather to regulate consumption. The government's priority is to cultivate a healthy population free from diabetes in the foreseeable future.

Did you read this?

MP Kuria Kimani is known for spearheading the Finance Act 2023. KImani has introduced a new bill aimed at enhancing revenue collection. In this latest initiative, the dynamic parliamentarian is targeting real estate developers involved in property construction and sales.

The Real Estate Regulation Bill, 2024, mandates real estate developers to obtain permits before conducting business within the country. This legislative proposal aims to bring order to an unregulated sector by establishing the Real Estate Regulatory Authority, tasked with overseeing the industry. The proposed functions include regulating and registering projects, as well as maintaining a public database on real estate.

According to the bill, developers providing false information to the authority will face penalties amounting to 5% of the estimated project cost, as determined by the board. Moreover, developers operating without the required permits could face a fine of Sh5 million or up to three years in prison.

If enacted, developers will need to pay Sh500,000 for permits and an annual renewal fee of Sh200,000. They will also undergo licensing procedures to safeguard purchasers' interests.

This initiative is expected to enhance revenue collection, considering the significant number of approximately 500 developers operating within the country.

-1732277552.jpg)