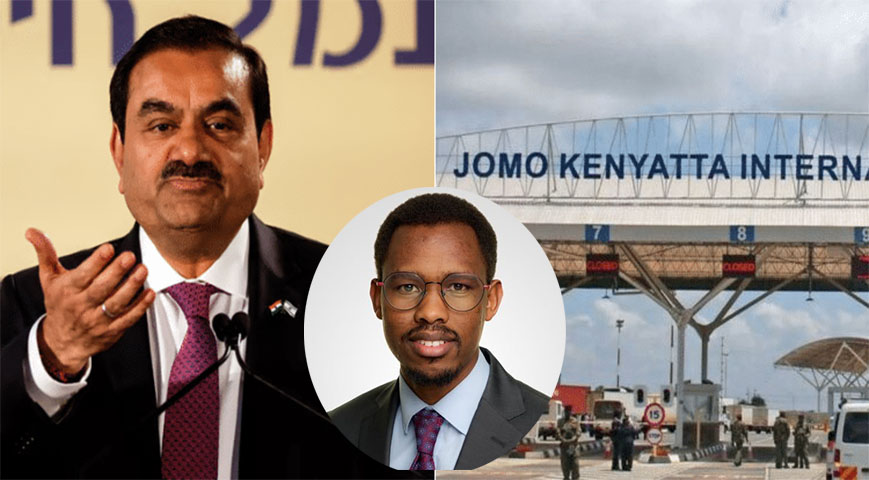

Nelson Amenya, the whistleblower behind the controversial plan to lease Jomo Kenyatta International Airport (JKIA) to India's Adani Airport Holdings Limited, says that he has been getting threats and that his life is in danger.

Just two months ago, Amenya started leaking documents outlining the terms of the proposed deal, sparking public outrage. Although the Kenyan government claims the contract is not finalized, it has faced backlash for its lack of transparency, with many questioning the agreement's secrecy.

During an interview with KTN, Amenya disclosed that he had received threats from both Indian bloggers and unknown individuals in Kenya. Additionally, he was approached by officers from the Directorate of Criminal Investigations (DCI), who warned him of possible legal charges.

The 30-year-old holds a Bachelor’s Degree in Design and Advertising from Moi University and is currently pursuing his MBA at HEC Paris, and he expressed concerns for his safety.

Did you read this?

He stated, "I’ve been threatened numerous times since exposing the deal, both by Indian bloggers and individuals here in Kenya. The DCI is using intimidation tactics with false charges."

Shedding light on the details, Amenya revealed that Adani seeks total control of JKIA and intends to use it as collateral for securing loans. The agreement would allow the company to terminate the deal if the government fails to protect its business interests.

Additionally, the Kenyan government would be required to pay Adani an annual concessional fee of Ksh. 50 million, paid quarterly in advance.

According to Amenya, one of the most controversial aspects is Adani’s request for the Kenya Airports Authority (KAA) 's title deed to be transferred to them. He also pointed out that after two years, Adani plans to renegotiate workers' contracts.

Amenya raised significant concerns about the deal's financial structure, questioning why Adani's payments would be funneled through Abu Dhabi instead of sent directly to Kenya from India.

He noted that the funds would pass through a Special Purpose Bond (SPB) in Kenya before being redirected through Abu Dhabi, a known tax haven.

"This setup raised red flags—why involve a middleman in Dubai? It points to possible money laundering schemes through SPBs," he added.