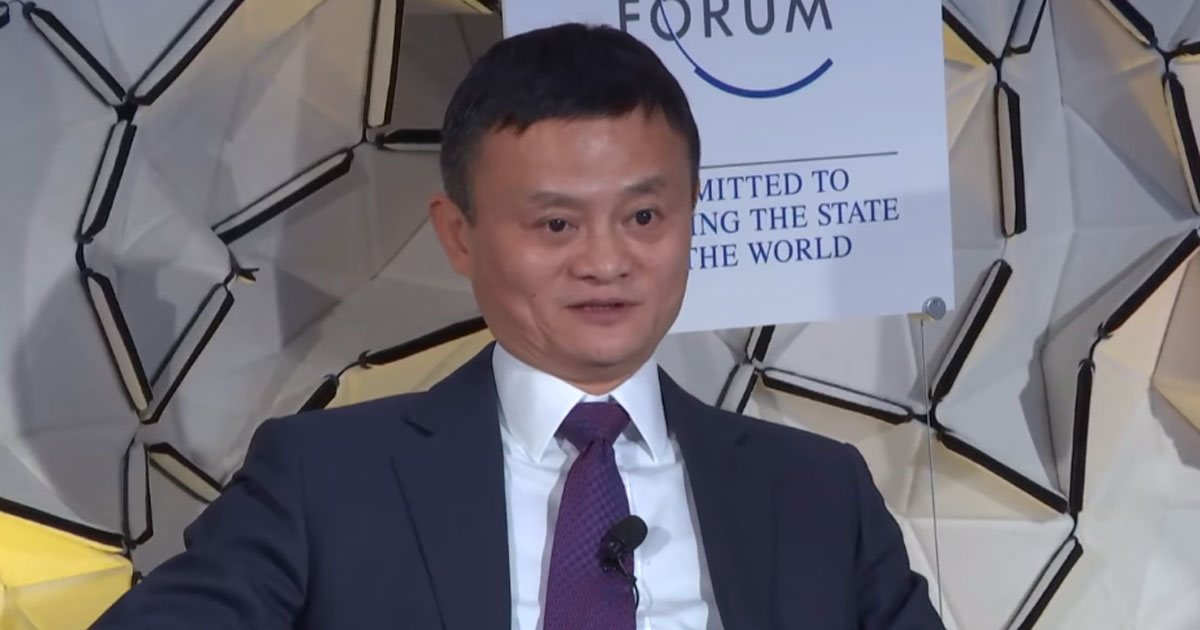

After stock prices fell, Chinese billionaire Jack Ma postponed selling hundreds of millions of dollars worth of Alibaba shares.

Last Thursday's regulatory filings indicated that Ma was looking to sell 10 million shares valued at almost $871 million.

However, despite the company's stock price having dropped below the billionaire's expectations, he has not sold "a single share," according to a Wednesday post on the company's internal forum viewed by CNN from Alibaba Chief People Officer Jane Jiang Fang.

According to the documents, the sales were originally scheduled for this Tuesday through JC Properties and JSP Investment, two organizations tied to Ma and his humanitarian foundation.

The planned sales were disclosed on the same day that Alibaba published third-quarter profits when it said it would abandon plans to spin off its cloud computing unit, partly due to uncertainty caused by US limitations on semiconductor shipments to China.

Alibaba's stock fell 9% in New York on Thursday and over 10% in Hong Kong on Friday, wiping off roughly $20 billion from the company's market capitalization.

Alibaba's stock has dropped more than 10% this year.

Jiang stated that the fact that both pieces of news arrived at the same moment was a coincidence.

The transaction sparked suspicion that Ma had lost faith in the company, but Jiang urged staff to reject such speculation. The executive stated that the agreements were part of a long-term strategy announced in August that would allow Ma's office to engage in agricultural technologies and welfare initiatives inside and outside China.

Ma feels the Hangzhou-based company's stock "is currently significantly lower than Alibaba's actual value, and he will not sell it," according to the report.

.jpg)

Alibaba Chairman Joe Tsai also chimed in, writing in a comment on the same page viewed by CNN that he had "full confidence" in the company.

On Friday, Ma's office informed the South China Morning Post, a Hong Kong tabloid owned by Alibaba, that he is "very positive" about the company's prospects despite plans for "a partial sell-down."

Ma's foundation and Alibaba did not react quickly to queries for comment on the topic or whether the share sale would occur if the company's stock price recovered.

The company is currently undergoing a massive restructuring, announced in March, and was originally expected to form six different companies, each with its own chief executive and board of directors.