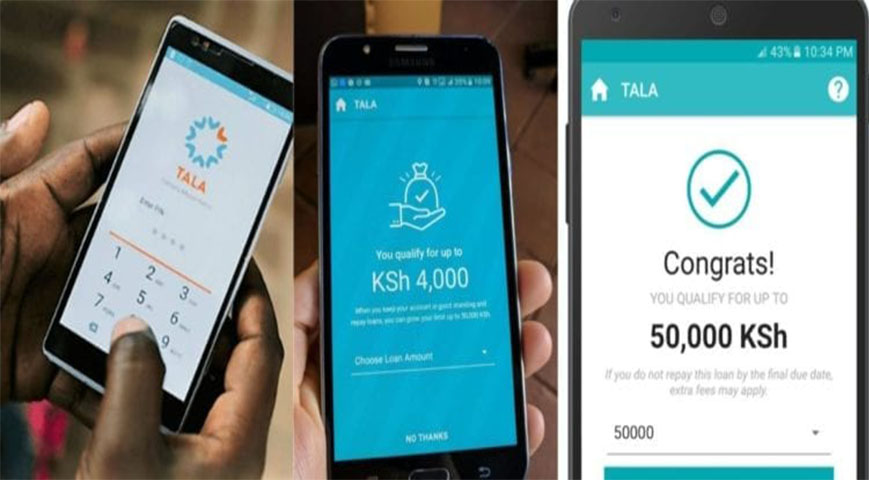

The Central Bank of Kenya (CBK) has approved 19 new digital credit organizations.

In a statement, the CBK said regulators, such as the Office of the Data Protection Commissioner, have assessed 480 applications received since March last year.

“The focus of the engagements has been inter alia on business models, consumer protection and fitness and propriety of proposed shareholders, directors, and management,” CBK said.

Did you read this?

CBK indicated that other candidates were at various stages of the process, with the majority awaiting the submission of required documentation.

The accreditation is part of a set of laws last year to filter out rogue actors in the expanding business and restrict how lenders handle customer data.

This came after it was revealed that certain companies contacted the families and friends of consumers who had defaulted on their payments or failed to pay on time.

There have also been complaints about some lenders demanding significant interest rates violating the Digital Credit Providers Regulations 2022.

CBK Governor Kamau Thugge informed parliament in December that they were investigating over 400 digital credit companies due to fraud concerns.