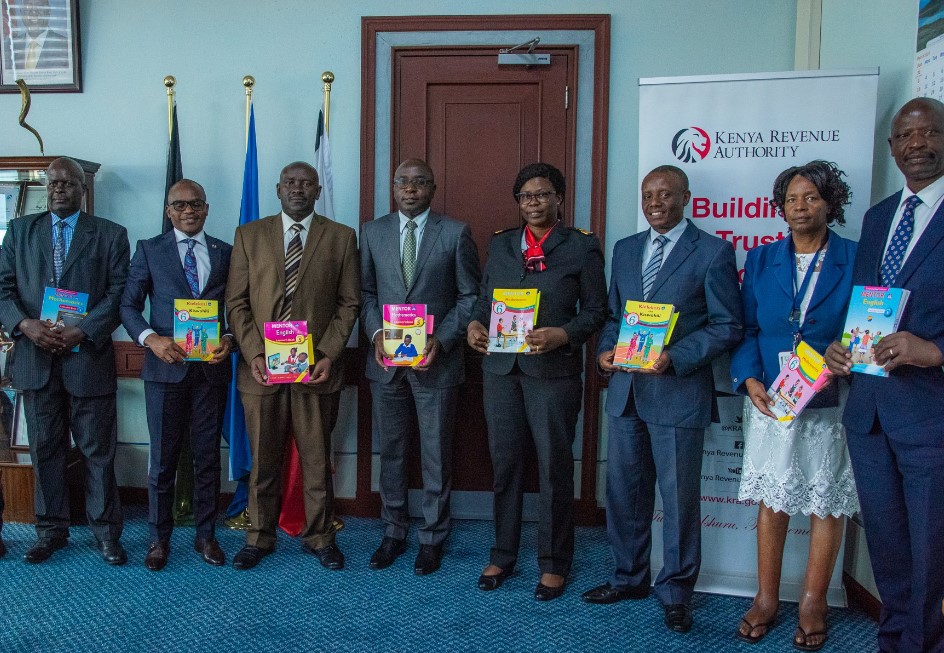

The Kenya Revenue Authority (KRA) has partnered with the Kenya Institute of Curriculum Development(KICD) to develop exclusive tax e-resources for students in Competency-Based Curriculum (CBC) to enhance student tax literacy.

In a statement on Wednesday, KRA stated that the program commenced with primary and secondary school students and will further progress to tertiary education.

According to the Authority, the collaboration will target learners in junior and senior high schools, upper primary education, primary teacher trainees, secondary teacher education trainees, teacher trainees in early years education, learners in early years education, and the general public.

“This collaborative effort between KRA and KICD represents a commitment to enhancing tax literacy and fostering a culture of understanding and compliance with tax obligations,” KRA stated.

“Through accessible and innovative digital resources, theaim is to empower students and the broader public with the knowledge and skills to navigate the tax landscape effectively.”

Did you read this?

Speaking during an engagement with KICD leadership, KRA Commissioner General Humphrey Wattanga stressed the need to engage young people in tax literacy to ensure the young generation evolves and becomes more informed and responsible about taxes.

“By learning about taxes at an early age, students become more informed and responsible citizens. Contributing to a long-term shift towards a society that values a fair and efficient tax system.”

TVET Senior Deputy Director Samuel Obudho said the program will ensure that the tax body reaches a wider audience.

“This partnership provides an efficient platform for KRA to reach a wide audience,” he stated.

Further, he stressed that the pact will be significant in ensuring that the younger generation gets up-to-date tax literacy with digital content in a simulation environment that will positively influence learners attitudes towards tax.