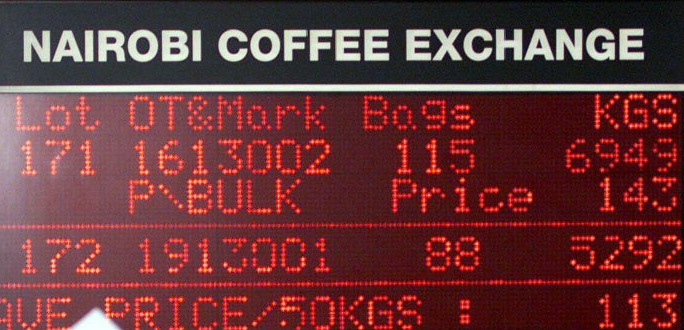

The Nairobi Coffee Exchange (NCE) now has until April 30 to implement the in-principle license given by the Capital Markets Authority (CMA) to continue functioning as a coffee exchange.

According to the Capital Markets (Coffee Exchange) Regulations, 2020, the approval, which has been extended through December 31, 2022, was given with the understanding that NCE would seek to fully comply with the Regulations.

The extension is expected to give impetus to the ongoing coffee sub-sector reforms.

Recently, President William Ruto gave his deputy, Rigathi Gachagua, the responsibility of leading reforms in the coffee sector. The DP made a commitment to farmers that he would concentrate on breaking up cartels in the subsector.

A direct settlement system provider must be onboarded by NCE in order to speed up and improve transparency in the settlement of coffee sale proceeds.

Trading rules must also be submitted that are in line with the Coffee Exchange Regulations in order to direct NCE's trading operations.

Finally, NCE must strengthen its governance structure by reconstituting its board in order to comply with the Capital Markets Regulations, 2011.

According to Wyckliffe Shamiah, chief executive officer of CMA, NCE is anticipated to instantly accept firms with active CMA-issued coffee broker licences on the trading floor.

The brokers holding valid licenses are; United Eastern Kenya Coffee Marketing Company; Meru County Coffee Marketing Agency Limited; Kipkelion Brokerage Company Limited; Mt. Elgon Coffee Marketing Agency; Murang’a County Coffee Dealers Limited; and Embu Coffee Farmers Marketing Agency Limited.

“CMA continues to engage all stakeholders in the coffee sub-sector to ensure that the momentum of the reform agenda is sustained and gains traction towards full implementation of the Coffee Exchange Regulations. This is expected to ensure the marketing and trading mechanism at the Coffee Exchange promotes fair trade, is transparent and enhances price discovery, ultimately benefitting the coffee farmers,” said Shamiah.

The CMA Chief Executive Officer welcomed the recent decision by the Agriculture and Food Authority to withdraw the amendments to the Crops (Coffee) (General) Regulations, 2019 which had slowed down the reform process by removing CMA from regulating the marketing and trading aspects at the Coffee Exchange.

The Capital Markets Act was amended in 2016 giving CMA the mandate to regulate spot commodity markets including the coffee commodity market.

CMA regulates the structured spot commodity markets in Kenya and in particular, the coffee commodity market according to Section 11(3) of the Capital Markets Act.