Starting a business in Kenya requires compliance with various regulations and obtaining relevant permits and licenses.

The process can be complex and time-consuming, but it is essential to ensure that the business is legally compliant and operating within the boundaries of the law.

I will discuss the business registration requirements and permits that are necessary to start and operate a business in Kenya.

Company Registration

The first step in starting a business in Kenya is to register the company with the Registrar of Companies.

The Companies Act (2015) provides for the registration of both local and foreign companies.

The process of company registration involves filing a Memorandum and Articles of Association with the Registrar of Companies, providing details of the company's directors, shareholders, and registered office.

The company must also have a unique name and must not be identical or similar to any existing company.

Tax Registration

After registering the company, the next step is to register for tax with the Kenya Revenue Authority (KRA).

The KRA is responsible for collecting taxes in Kenya, and all companies must register for tax within 90 days of incorporation.

The tax registration process involves obtaining a PIN number and submitting tax returns periodically.

The company must also keep proper records of its financial transactions and make timely tax payments.

Work Permit

Foreign investors who wish to start a business in Kenya must obtain a work permit from the Department of Immigration.

The work permit is required for the foreign investor to reside and work in Kenya for a specified period.

The work permit application process involves submitting various documents, including a business plan, educational certificates, and medical certificates, among others.

Business Licenses

Once the company is registered and has obtained the necessary permits, it must obtain the relevant licenses to operate the business.

The type of license required depends on the nature of the business. For example, businesses that operate in the manufacturing sector must obtain a manufacturing license, while those in the hospitality sector must obtain a hotel license.

Environmental Permits

In Kenya, businesses must comply with environmental regulations, and some businesses are required to obtain environmental permits.

The National Environment Management Authority (NEMA) is responsible for issuing environmental permits and ensuring that businesses operate within the bounds of the law.

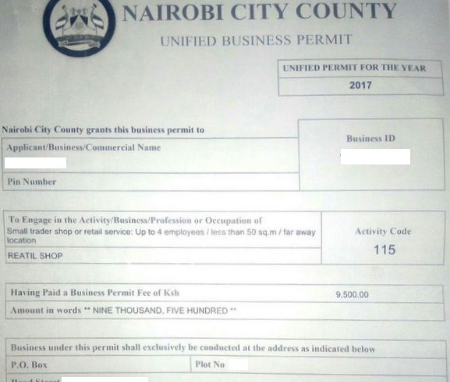

Trading License

Businesses that operate in the retail sector must obtain a trading license from the local county government.

The trading license is necessary to operate a retail business and must be renewed annually.

The trading license application process involves submitting the required documents, including proof of business registration and payment of the license fee.

Summary

Starting a business in Kenya requires compliance with various regulations and obtaining relevant permits and licenses.

The process can be complex, but it is essential to ensure that the business is legally compliant and operating within the bounds of the law.

The key business registration requirements and permits include company registration, tax registration, work permit, business licenses, environmental permits, and trading license.

By following the steps outlined in this essay, entrepreneurs can ensure that their businesses are legally compliant and operate smoothly in Kenya.