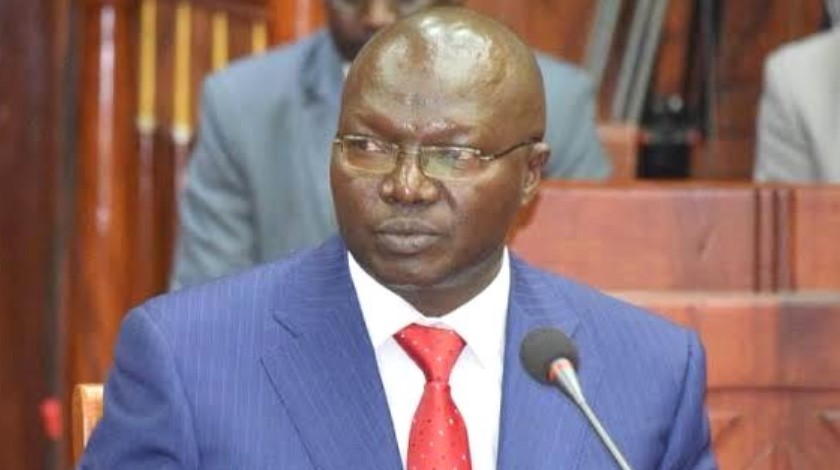

According to the latest data by the Cooperatives Cabinet Secretary Simon Chelugui, Nyeri county leads in the repayment of the Hustler Fund with 76.3 per cent.

It was followed by Kiambu at 75.3 per cent while Nyandarua takes the third position with 74.5 per cent.

Nairobi, which boasts the highest number of subscribers at two million, is placed fourth with a repayment rate of 73.8 per cent.

Other counties in the top ten include Laikipia (73.6 per cent), Nandi (73.5 per cent), Muranga (73.3 per cent), Embu (73.1 per cent), Uasin Gishu (73.1 per cent) and Nakuru (72.9 per cent).

Nationally, the repayment rate stands at 69 per cent since e its launch according to the CS.

Did you read this?

"We're building a very good story backed by data. I am particularly impressed by the positive attitude shown by majority of the beneficiaries and Kenyans in general."

Regarding age, the youth who fall between 18-29 years leads the chart of borrowers with 38.5 per cent followed by those between 30-39 who control 28.8 per cent. People aged between 40-49 per cent have so far recorded a 17.5 per cent borrowing rate.

And, in terms of gender, more men borrow Hustler Fund compared to women at 66 per cent and 34 per cent respectively.

So far, Sh31.5 billion has been disbursed, while loan repayment stands at Sh21.2 billion. The savings account now stands at Sh1.5 billion.

The number of people who have registered with the fund now stands at 20 million, while 7.1 million have borrowed from the kitty and repaid more than once.