According to the latest Ministry of Cooperatives and MSME Development data, 57 percent of the Hustler Fund borrowers are using Mulika Mwizi to access loans.

This is compared to those using Android phones, which make up 43 percent.

Further, more than half of the Hustler Fund beneficiaries are youths; those between 36-55 years are 35 percent, while those above 55 percent are only nine percent.

Men have borrowed more than women going by the data at 57 and 43 percent, respectively.

Additionally, the amount disbursed had hit Kes 6.5 billion, with Kes 722 million repaid in the same period, translating to 10 percent of the total amount disbursed so far.

More than 14 million Kenyans have registered with the fund, while borrowers have saved Sh328 million from some 11 million transactions.

The number of Kenyans who have borrowed more than once stands at slightly over 700 000.

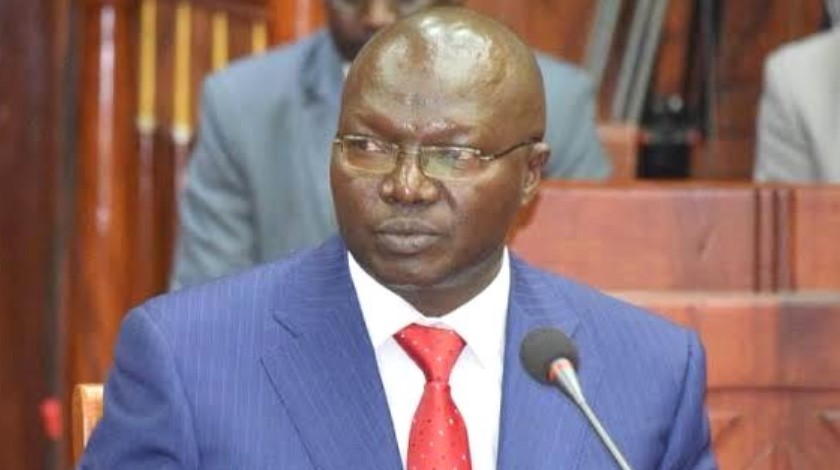

Cooperatives and MSME Development Cabinet Secretary Simon Chelugui says going by the data; Hustler Fund is progressing well, noting that early gains continue to be recorded.

"Hustler Fund is a product of meticulous planning and execution. It is solving a properly diagnosed financial problem afflicting ordinary (Hustlers) Kenyans," Chelugui said.

The fund, he said, is designed to spur growth, especially at the bottom of the pyramid.