President William Ruto has said that the hustler fund is set to collect more money in savings than what is collected by the National Social Security Fund (NSSF).

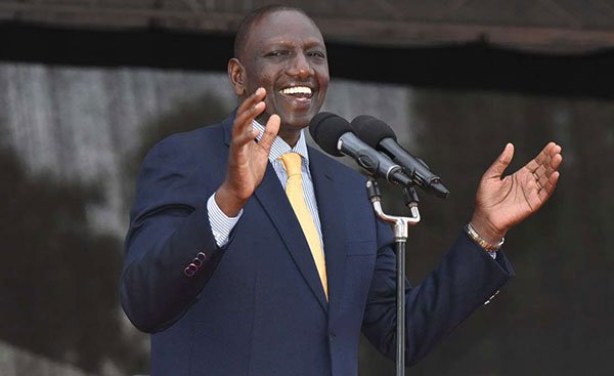

Speaking during the launch of about 5300 affordable housing units project in Machakos County, Ruto confirmed that Kenyans have saved Kes 250 million since the fund's launch.

“In the last week, Kenyans have saved Kes 250 million. With this trajectory, Hustler Fund is set to collect more money in savings than what is collected by NSSF currently,” he said.

Savings from the Hustler Fund scheme are deposited into a savings account after deducting 5% of the borrowed money.

When a customer borrows, the approved loan is disbursed to their mobile money account, with 95% deposit to the mobile money wallet and the remainder deposited to the savings account.

The savings scheme will divide savings into 70% long-term and 30% short-term, resulting in 70% of the 5% going into the long-term (pension) and 30% going into the short-term.

Further, Ruto said that saving will help build the country's economy, saying that the government should drive its development using its own money without seeking foreign aid.

"The loans the country is borrowing from all over the place is because we do not have our own savings. The money we borrow from China and those other entities comes from savings from people of those nations," he added.

This comes at a time when the Treasury is seeking to borrow Kes 92 million from the World Bank to stabilize the country's economy.

National Treasury CS Njuguna Ndung'u speaking at the World Bank's Country Partnership Framework launch for 2023-28 in Nairobi, said they are willing to get $1 billion.

"We have been trying to negotiate this to $1 billion, but World Bank has been adamant," he said.

The appeal for the new facility is coming nine months after the lender gave Kenya a similar amount to help accelerate ongoing inclusive and resilient recovery from the Covid-19 pandemic.

The $750 million approved by World Bank in March was part of the Development Policy Operation(DPO) that intended to help strengthen fiscal sustainability through reforms that contribute to greater transparency and the fight against corruption.