Following Nairobi Governor Johnson Sakaja's approval of the county's Finance Bill 2023, new levies will disproportionately affect city drivers, boda boda riders, and club owners.

In the fiscal year ending June 30, 2024, the county government will receive Sh19.9 billion in own-source revenue thanks to the new levies introduced by the Bill, now an Act.

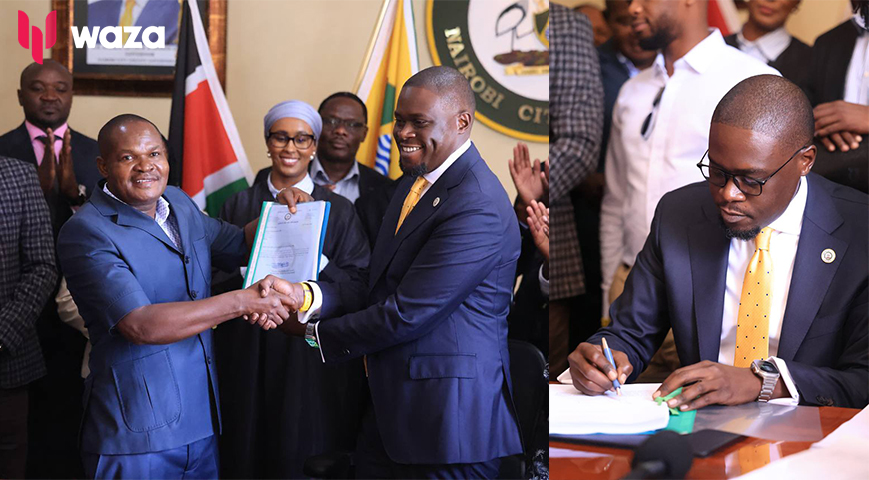

Given the absence of a comprehensive financial act for many years, Sakaja, who consented to the Bill on Friday, said it is a breakthrough piece of law for the city.

However, removing the idea of taxing clergy, politicians, and women for utilizing public spaces throughout the city is welcome news for all of them.

Initially, the county had suggested charging a charge for usage of the Jacaranda and Kamukunji sites. Religious leaders were required to pay Sh20,000 for each day they intended to rent the facilities for rallies and crusades.

Did you read this?

More than 70% of our Health Pharma and Non Pharma Products and commodities are imported yet we have the potential to manufacture a significant percentage of them locally. pic.twitter.com/x7yuh8QpZj

— Sakaja Arthur Johnson (@SakajaJohnson) October 13, 2023

Politicians who planned to hold rallies on the grounds at Kamukunji would have to pay Sh100,000.

The preachers and politicians will still need a permit from City Hall to use the grounds despite the dismissal of the charges.

It also benefits women because they won't have to spend more money on family planning services.

According to Governor Sakaja, women in Nairobi are vehemently opposed to the tax hike.

"We had initially proposed new charges on reproductive health but, during the public participation, the public expressed their views and we heard and maintained and reduced some of the charges," he said.

Alternatives for Basic Education and Training Provision Schools used to pay Sh10,000 annually, but that amount has been cut to Sh3,000 with the option of paying Sh1000 every term.

Joined H.E @WilliamsRuto, CSs @CSRebeccaMiano, @Nakhumicha_S and Local Manufacturers this afternoon at the KICC and engaged in discussions on how the National and County Governments can support the spurring of local manufacturing for the supply of quality health products and… pic.twitter.com/bj7zuAP6ll

— Sakaja Arthur Johnson (@SakajaJohnson) October 13, 2023

According to Sakaja, the action will protect APBET schools, which are crucial in supplying Nairobi's children with a foundational education.

However, after the growth in alcoholic beverages and licensing, club owners had nothing to worry about. According to the governor, most citizens who participated in the public discussion recommended the hefty fees to curb drug and alcohol misuse.

With the addition of clearly defined parking zones, the parking regulations experienced substantial alterations.

Since the city plans to implement new technologies to ensure people get value for their money, this implies that motorists' pockets have also been robbed, and they now have to pay more.

The daily parking fee is currently Sh200.

I have today assented to the Nairobi County Finance Act 2023, the instrument through which we shall find the delivery of services to you. We commit to prudent use of your hard earned resources and will soon publish a schedule of fees and charges for your clarity. pic.twitter.com/jLOzKBXE9E

— Sakaja Arthur Johnson (@SakajaJohnson) October 13, 2023

According to the new Finance Act 2023, drivers can only park for free for two hours on Fridays (12:30 pm–2:30 pm) in Zone I and Zone II neighborhoods near mosques.

The first hour of parking in Zone I and II regions will cost Sh100.

For each additional hour of parking in Zone I or Zone II, drivers must pay Sh50 and Sh100, respectively.

Kijabe Street, Westlands, Upperhill, Community, Ngara, Highridge, Industrial Area, Gigiri, Kilimani, Yaya Center, Milimani, Hurligham, Lavington, Karen, Eastleigh, Gikomba, and Muthaiga are among the zones of Zone I.

On-street parking in commercial areas and non-automated county market parking are areas regarded as belonging to Zone II (excluded from Zone 1).

In accordance with the mandate by the former president Uhuru Kenyatta to establish automated hourly automobile parking facilities in three regions of Nairobi, it claimed to have automated Sunken Automobile Park, Nairobi Law Courts Parking, Desai Road, and Machakos Bus Station.

I’m grateful to all the people of Nairobi who participated in this process through public participation forums, those who sent memoranda, the Speaker, leadership and the Members of The County Assembly of Nairobi as well as the Executive of Nairobi. Lazima iWork. pic.twitter.com/E4xxacysG9

— Sakaja Arthur Johnson (@SakajaJohnson) October 13, 2023

Daily on-street parking in Zone I non-automated zones would rise from Sh200 to Sh300 for saloon cars.

Vans and pick-up trucks will be taxed Sh500 starting at Sh200; lorries (up to 5 tons) and minibusses will be charged Sh1,000; and lorries carrying weight beyond 5 tons will be fined Sh3,000.

Buses that are not PSVs must pay Sh1,000 to park on the street in Zone I's non-automated regions.

While van and truck parking costs have increased from Sh200 to Sh300 in Zone II, salon car drivers will continue to pay the lower rate of Sh100.

For parking, lorries carrying up to 5 tons of weight will pay Sh500, while those carrying more than 5 tons will now pay Sh2,000 instead of the previous Sh1,000.

Parking costs for non-PSV buses will be reduced to Sh500 from Sh1,000.

Additionally, new fees for the registration of taxis and boda bodas have been added under the Finance Act of 2023.

Now, taxi drivers must pay an annual registration cost of Sh1,500, while boda boda operators must pay Sh1,000.

Due to the Act's higher application fees for outdoor advertising and signs, advertisers will also have to pay more.

The fees vary depending on the advertisement's size, duration, and position.

The Act also addressed physical planning, land use, and housing as significant sources of revenue. Although a 25% rent increase was sought in the initial proposal, it was later decreased to 10% after stakeholder talks.

For the convenience of residents, City Hall will make available a detailed schedule of all fees specified in the Act and earlier Finance Acts.

#WanaWork pic.twitter.com/6DqgnYZ80W

— Sakaja Arthur Johnson (@SakajaJohnson) October 12, 2023

To collect money and provide services to more than 4.3 million Nairobi residents, Sakaja is relying on the new Finance Act.

The budget for this year, the first under the Sakaja administration, is Sh42.3 billion, with Sh28.3 billion going toward ongoing expenses and Sh14 billion going toward development.

Residents should hold the county government responsible if they don't receive the required services, said Deputy Governor Muchiri Njoroge.

“This is the highest budget ever we passed this year and it is meant to fund the county to provide services to the residents. It is good to hold us to account in the manifesto we promised during campaigns,” he said.

Sakaja pleaded with Nairobi residents to pay their taxes, admonishing that enforcement would be stepped up to guarantee compliance.

"It would be incredibly unjust for inhabitants of Nairobi to avoid paying taxes while taking advantage of things that his neighbors pay for. He said that others can't get free rides while others pay taxes.

All 123 MCAs supported the Finance Bill, according to County Assembly Speaker Ken Ng'ondi, and it was passed without any resistance.