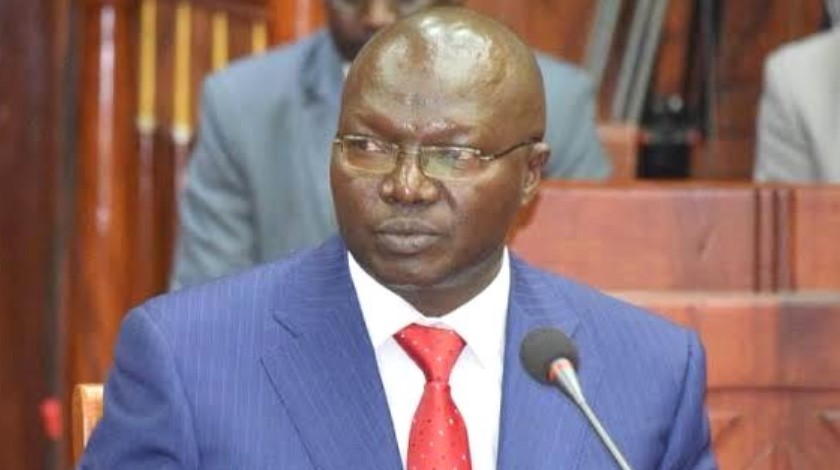

Cooperatives and MSMEs Development CS Simon Chelugui has said that mobile networks and financial institutions are the ones setting limits for customers borrowing the Hustler Fund.

The CS was responding to a question on why limits for some Kenyans who had repaid were yet to increase.

He said the network providers and banks engaged by the government were relying on previous individual records.

"They are using historic information available on their systems as communication and consumption of airtime," he said.

Further, he said that the setting of limits was done through an algorithm system.

Additionally, the CS disclosed that the highest amount lent so far was Kes 5,000 with the minimum being Kes 500.

So far, Kes 9.5 billion has been disbursed by 9 am today as per the data released by the CS.

Chelugui stated that borrowers have saved Kes 480 million from some 17 million transactions recorded so far.

“By 9 am today, Sh9.6 billion had been disbursed to hustlers… more than 16.5 million Kenyans have been registered and are accessing the fund,” he said.

In addition, the CS has called on Kenyans to adopt the borrow-and-pay model as this is the only way one can grow with the Hustler Fund.

Lauding Kenyans for embracing the Fund wholeheartedly, the CS also urged them to pay back the loan on time noting this would enhance their creditworthiness.

“One of the biggest discussions during the campaign was the establishment of the Hustler Fund to support ordinary Kenyans and our president fulfilled this promise by launching the Fund on November 30,” the CS said.

Kenyans who have borrowed the fund had repaid Kes 2.7 billion so far, translating to 23 per cent of the amount disbursed so far.

The number of Kenyans who have borrowed more than once now stands at 2.7 million and growing by the minute.