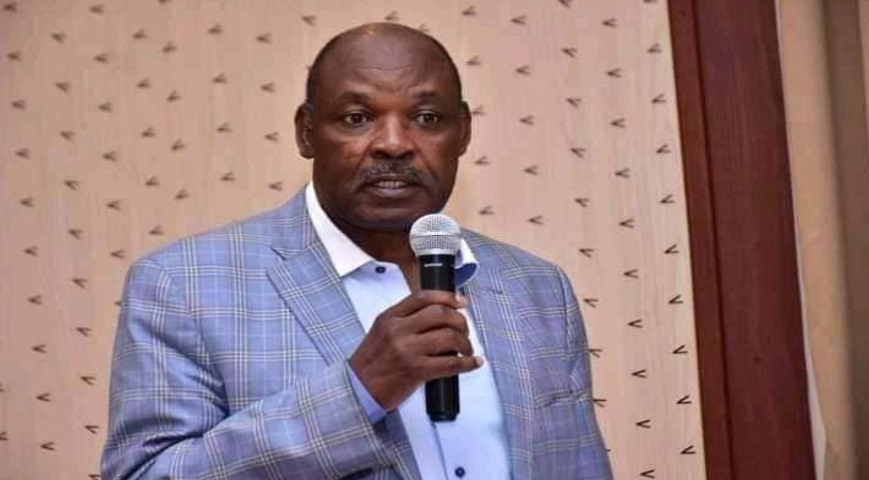

Former Kisumu Governor Jack Ranguma is embroiled in a bankruptcy lawsuit due to a decade-long debt and an extended legal battle with an insurance company.

Mua Insurance has petitioned the court to declare Ranguma bankrupt over a debt dating back to 2012, which the company claims amounts to approximately Sh8 million.

This development comes just six months after the company obtained court orders to seize Sh7.8 million from Ranguma's Absa bank account.

“Take notice that within 21 days after service of this notice on you (Jack Ranguma), excluding the day of service, must pay Mercantile Insurance Company (Now trading as MUA Insurance (Kenya) the sum of Sh1,436,365.38 and USD48,881.20 as September last year which amount continues to accrue interest at court rates,” the insurance firm said in the insolvency cause dated January 22.

“Take further notice that failure to pay the afore-stated amount shall result in Mercantile Insurance Company filing for a bankruptcy order against your estate.”

The insurance firm is being represented by lawyer Pearlyne Omamo of ADRA Advocates LLP.

The debt originated from Ranguma's travel agency's failure to remit proceeds from passenger ticket sales to the International Air Transport Association (IATA). Subsequently, IATA transferred the claim to Mercantile, now re-branded as MUA, with an agreement for the insurance company to pursue the travel agency.

Now serving as the chairman of the Sacco Societies Regulatory Authority, the former governor finds himself bearing the brunt of the debt, as interest continues to accrue.

He has settled the principal amount by paying Sh9.6 million. Additionally, Sh7.8 million was seized from his bank account, yet the insurance company is still pursuing the remaining Sh8 million.

“The fact that the decree-holder is a successful litigant with the right to reap the fruits of its judgment, I agree with the counsel for the decree-holder that the funds held by the garnishee (Absa Bank) on behalf of the judgment debtor should be used to offset part of the said debt. It's however noted that the said funds are not sufficient to settle the entire debt,” Justice Njoki Mwangi said in a judgment dated September 22 last year.

Ranguma says he has filed an application for appeal against the judgment, claiming that the insurance firm has turned him into a cash cow.

“For a debt of Sh8,961,504, the creditor has now been the recipient of Sh18,613,639.2. I am no longer a debtor but a perpetual cash cow for the purported creditor,” he stated in court papers seen by the Star.

He termed the insolvency suit as an attempt to “steal a march” because of his intended appeal which he says hold “significant merit”

Lawyer Pearlyne Omamo however contends that Ranguma has demonstrated lack of commitment to settle the debt, citing among others his acquisition of properties.

“It was stated by the decree-holder (insurance) that the court records confirm that the judgment debtor (Ranguma) has been acquiring assets and even campaigning for the position of governor in the recently concluded elections in flagrant disregard of his obligation to settle the outstanding sum,” Justice Mwangi said in her judgment.

In 2022, Ranguma made an unsuccessful bid for the Kisumu gubernatorial seat, ultimately losing to Governor Anyang’ Nyong’o.