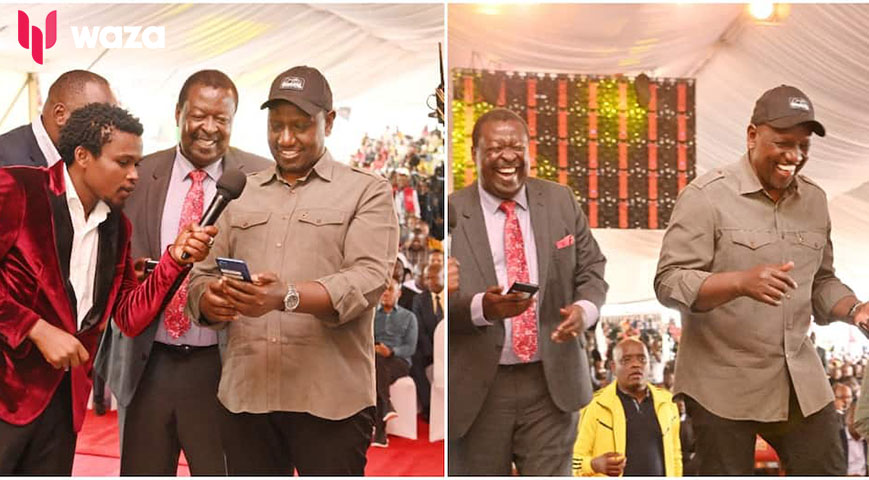

President William Ruto on Monday announced revised lending terms for the Financial Inclusion Fund, popularly known as the Hustler Fund, during its second-anniversary celebration at the Kenyatta International Convention Centre (KICC) in Nairobi.

A key highlight of the update was the introduction of a new "loan bridge" product targeting borrowers with good repayment histories. These borrowers will now enjoy increased credit limits and extended loan terms. Under this product, borrowers can access a 30-day term loan, compared to the current 14-day personal loan, with a rollover option for another 30 days at an annual interest rate of 8%. A one-month rollover will come with a slightly higher interest rate of 9.5%.

Ruto explained that enhanced credit limits will be based on individual credit scores, with some borrowers qualifying for double or even triple their current limits.

Did you read this?

“The beneficiaries will establish a relationship with banks, gaining banking experience and building a credit history to improve their bankability. Limit increases will depend on the Hustler Fund behavioural credit rating of the borrower,” said Ruto.

The Hustler Fund currently offers loans ranging from Ksh.500 to Ksh.50,000 at a daily interest rate of 0.002% or an annualized rate of 8%.

To support the initiative, the government has introduced a Hustler Fund credit score system, which rates borrowers across nine bands, from A1 (Excellent) to C3 (Poor). This score will determine creditworthiness and allow borrowers to leverage their scores when applying for loans from other financial institutions.

“Over two million Hustler Fund beneficiaries have demonstrated responsible borrowing behaviour, earning them access to enhanced credit limits. To date, the fund has recorded over seven million repeat borrowers,” said Ruto.

Launched on November 30, 2022, the Hustler Fund was created to provide credit access to Kenyans previously locked out of borrowing due to blacklisting by credit agencies. It also includes a mandatory savings component, with 5% of every loan disbursed allocated to savings—70% for long-term savings and 30% for short-term.

As of October, the Ministry of Cooperatives and Micro, Small, and Medium Enterprises Development reported that over Ksh.57.8 billion had been disbursed through the fund, with Ksh.45.5 billion repaid. However, the fund’s CEO, Elizabeth Nkuku, recently informed Parliament that the government is considering measures to recover outstanding debts.