Kenyans can now enjoy a two-year credit plan when buying home appliances and electronics from Hotpoint.

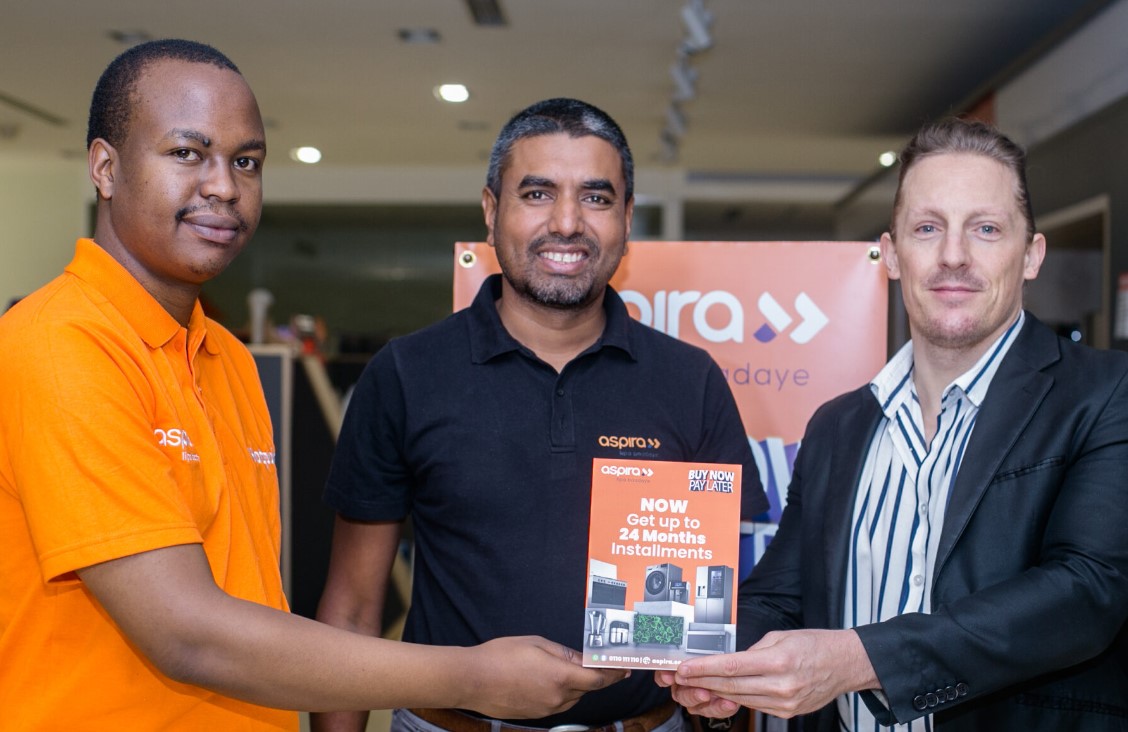

This is after Hotpoint in partnership with Aspira unveilled a 24-month ‘buy now, pay later’ plan that seeks to make high-end products more accessible to Kenyans.

Aspira Chief Operating Officer(COO) Irshad Muttur noted that the partnership aims to make quality appliances and a comfortable lifestyle affordable and manageable for people in Kenyans.

“Kenyans aspire to have a good life, and with this partnership, they can now access essential appliances over a more extended period,” said.

According to Muttur, Aspira’s flexible payment plans, which range from 1 month to 6 months, have already been well-received by Kenyan shoppers.

Did you read this?

The addition of the 24-month plan allows consumers to spread the cost of their purchases over a more extended period, aligning with the lifespan of many durable appliances.

On his part, Hotpoint Head of Marketing, Chris Rhys noted that the 24-month product will allow more customers to access a broader range of products.

“Previously, some high-end appliances and electronics may have been out of reach for many shoppers due to shorter payment terms.”

“Now, customers can consider these items and extend their payment terms, which is a win-win for both customers and Hotpoint,” he said.

The Kenya Buy Now, Pay Later 2023 report showed that Kenya’s BNPL payment industry has recorded strong growth over the last two years due to increased e-commerce penetration.

The report predicts BNPL payments in the country to grow by 51.6 percent on an annual basis Kes 124 billion in 2022 to reach Kes 310 billion at the end of 2023.