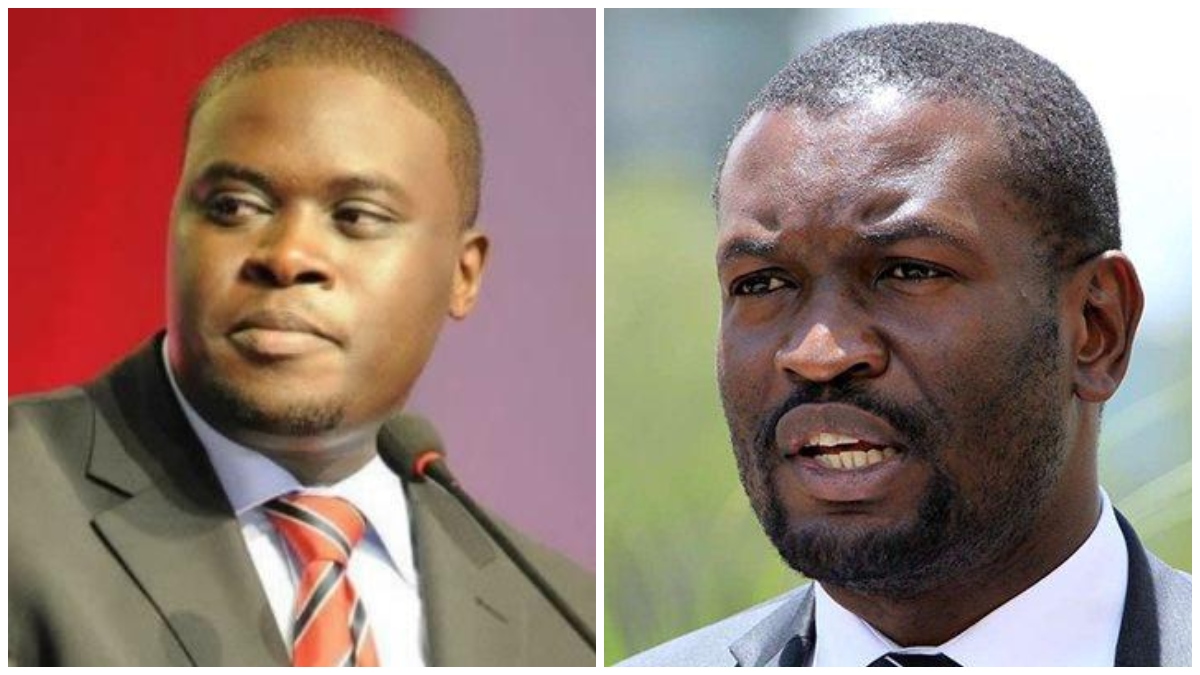

Nairobi Senator Edwin Sifuna has encouraged Governor Johnson Sakaja to listen to city residents' concerns about the high cost of living and the planned Finance Bill 2023, which seeks to introduce taxation on various topics.

Senator Sifuna suggested that Governor Sakaja's secondary role is to listen to Nairobians' grievances and then relay them to the government of the day, on whose party ticket he was elected and thus likely belongs.

Sifuna stated on Thursday when Nairobi joined other counties in commemorating Madaraka Day, the country's capital's economy was suffering and that locals were grumbling about the high costs of staples such as maize flour.

Did you read this?

He claims that the proposed taxes in the Finance Bill will not lessen the burden that ordinary mwananchi bear but will instead increase it.

"Serikali hii yenu imeleta mswada kwa Bunge kusema mtu wa salon pia yeye alipe ushuru ya fake weave." Ati leo nikipata ajali alafu insurance mnataka ushuru....inawezekana kweli?" Sifuna posed.

"Nyinyi mlisema mnatetea watu wa chini; yaani mama akiuza samaki tano kwa soko mnataka ushuru, akieka nywele mnataka ushuru." "Sisi watu wa Nairobi tunapinga huo mswada kwa sababu tumechoka na mzigo, msituongezee mzigo zaidi," says the mayor of Nairobi.

"Maisha imetushinda hapa Nairobi," she says. Watu ya unga imeshinda bei. Sisi watu wa Nairobi tunapinga huo mswada kwa sababu tumechoka na mzigo. Imechoka punda. Mzigo zaidi msituongezee."

The proposed Finance Bill 2023 also seeks to remove 3% of Kenyans' basic salaries for the National Housing Development Fund, which another 3% from the employer would match.

Digital content makers will also be subject to a 15% withholding tax on all content they monetize.

Still, in the digital realm, the new digital tax will apply to the transaction of any digital assets, including cryptocurrencies, token codes, and Non-Fungible Tokens (NFTs).

The Finance Bill proposes amending Section 5 of the Income Tax Act to guarantee that employees' per diem, sometimes known as cash allowances, are taxed properly.

The new idea will give the government legal authority to collaborate with companies to develop a functional framework to ensure employees pay their fair amount.