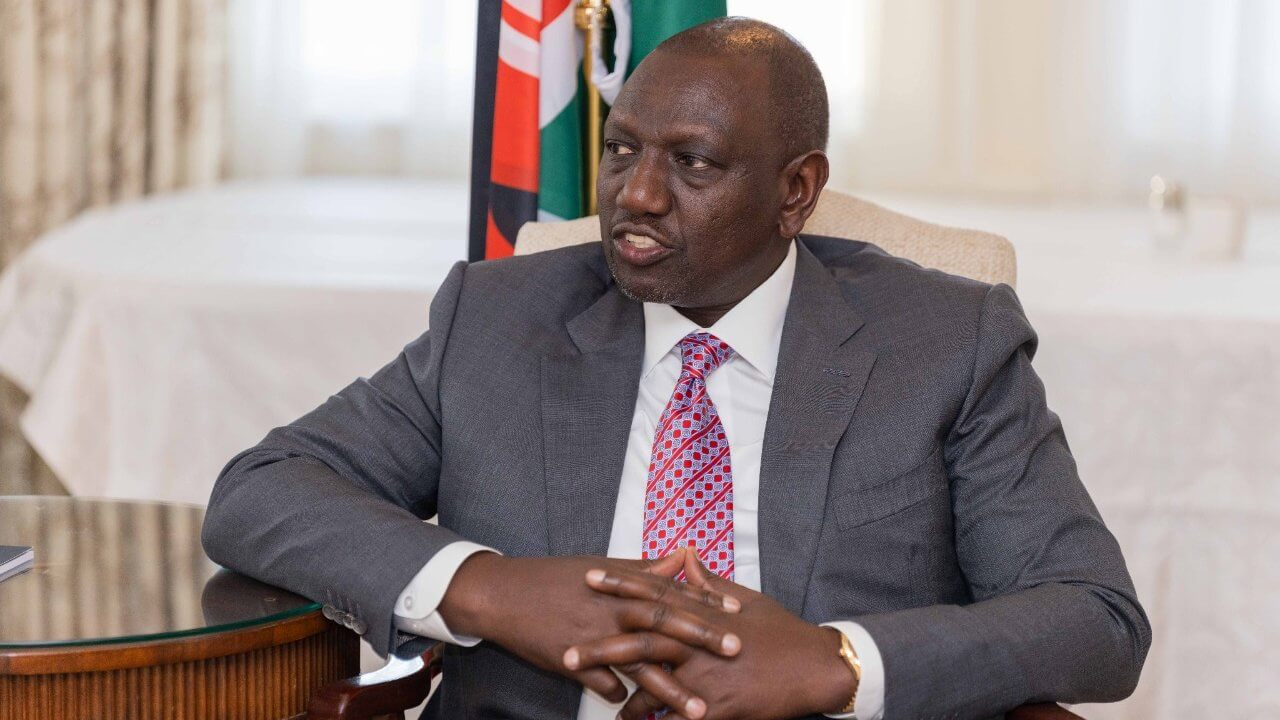

Kenyan President William Ruto requested a 10-year delay in repaying the nation's debt from its financial backers.

President Ruto remarked that this would instantly enable the resources that would have been utilized for debt servicing to be used to sort out other urgent difficulties during his speech in France during the Summit for a new Global Financing Pact.

In addition, President Ruto accused the World Bank and the IMF of making 'unfair' loan agreements that had led to Africa's debt burden.

"Shareholders of multilateral development funding institutions cannot longer be permitted to vote on specific issues. So how can we maintain the stockholders' satisfaction? Let's assure them that we will settle our bills. Make the debt a 50-year loan with a 10- or 15-year grace period. And we begin by failing to pay the money that is due the following year. The president of Kenya said, "And they give us ten years.

Did you read this?

President Ruto claimed that while Kenya spends $5 billion annually to repay its debts, if granted a grace period, it could use the money to develop its infrastructure, give energy, and provide water to its citizens.

He said, "We will still pay our debt; it has just been delayed so that the shareholders have no issues and we have immediate money to deal with our situation so that we are not doing badly."

The Head of State added that Kenya's expectations from the Summit included how to obtain emergency cash, how to obtain extra funding based on urgency and magnitude, and how to address the debt burdening many developing nations.

President Ruto claimed that while Kenya spends $5 billion annually to repay its debts, if granted a grace period, it could use the money to develop its infrastructure, give energy, and provide water to its citizens.

He said, "We will still pay our debt; it has just been delayed so that the shareholders have no issues and we have immediate money to deal with our situation so that we are not doing badly."

The Head of State added that Kenya's expectations from the Summit included how to obtain emergency cash, how to obtain extra funding based on urgency and magnitude, and how to address the debt burdening many developing nations.

"The system predisposed us to be in debt. If you pay eight times (more), your likelihood of being in debt is eight times greater than that of the next individual. How can we escape this? Our recommendation is that we come to an understanding on a win-win before we leave here," he continued.

Kenya's public debt as of right now is around Sh9.4 trillion. According to the World Bank, the debt is 67% of GDP, and when combined with the IMF lending rates, the nation is in a severe debt crisis.