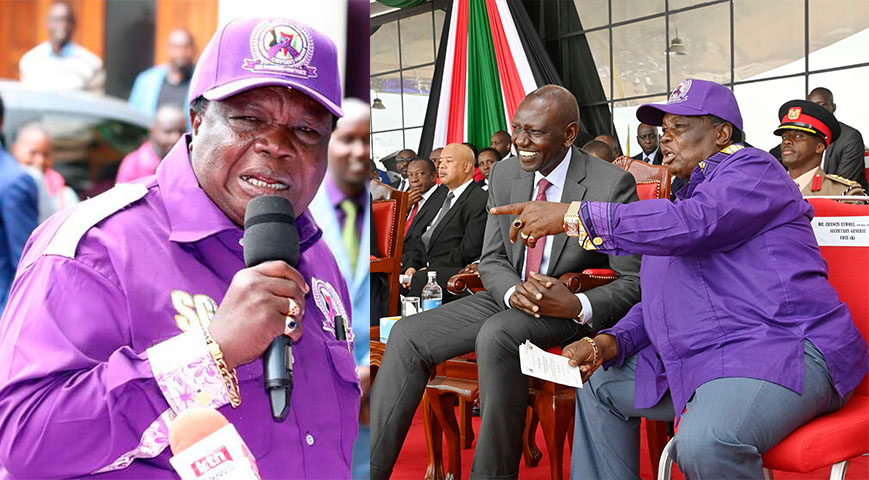

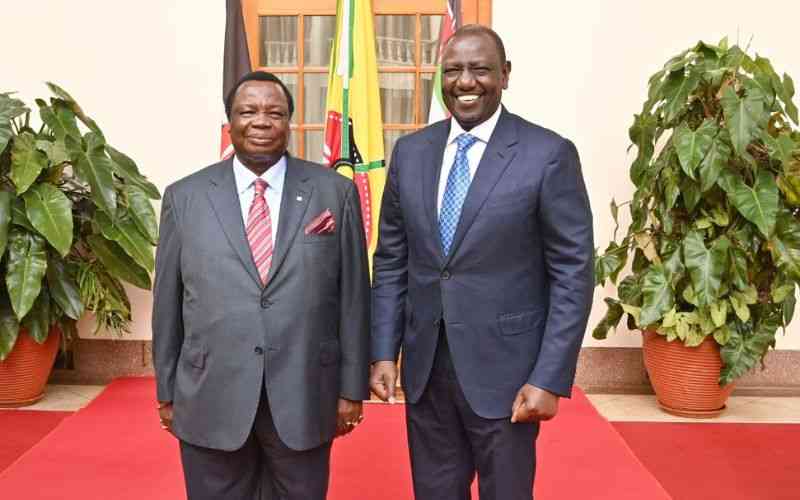

Francis Atwoli, the secretary general of the Central Organization of Trade Unions (COTU), has pleaded with lawmakers to reject any legislation that would increase worker tax deductions.

Atwoli requested that Ikolomani MP Bernard Shinali drop the unemployment insurance authority bill, which aims to tax workers and let those who have been suspended from work receive their salary while speaking at a funeral in Kakamega county.

Atwoli asserts that many workers are struggling to make ends meet as a result of the hefty taxes levied by the government and claims that the raises will result in many informal workers taking home pocket change.

.jpg)

"People's payslips are being significantly withheld, thus I would want to beg Shinali to drop any plans for the employment levy. Nothing else is left on our paystubs,"

Did you read this?

"We can only expand our economy if we have established our economic viability as a nation. Kenya Kwanza is now setting up a method to investigate if it can promote economic growth. But let's avoid burdening Kenyans with yet another task first.

Atwoli's comments align with several freshly enacted VAT increases by the government in the Finance Act 2023 to boost the country's faltering economy.

The government declared that Kenyans in the formal sector will contribute 3% monthly to the Housing Fund, starting with the most contentious one.

Both the employer and the employee must pay a 1.5% charge each.

Petroleum products increased from 8% to 16%, imports of used cars and other increases were made.

Advertising expenses for alcoholic beverages, wagering, gaming, lotteries, and prize competitions on TV, print media, billboards, and radio stations will attract an Excise Duty of 15%. Media sector players have not been spared either.

Following the increase in Excise Duty to 15%, millions of Kenyans who use mobile money services would also pay more for the services.