For the past one and a half years, Ruto has been in office. Kenyans have been complaining about the rising cost of living and over-taxation. Everything is being taxed; even if you own one chicken, you must pay tax.

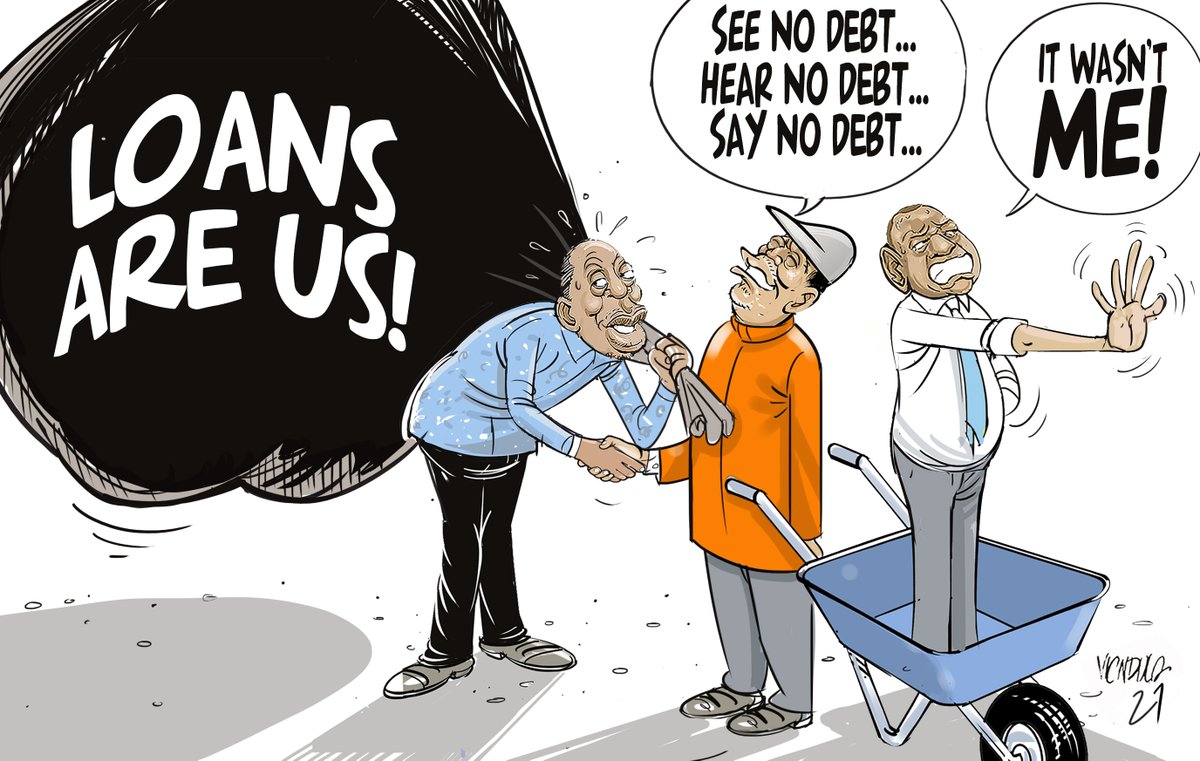

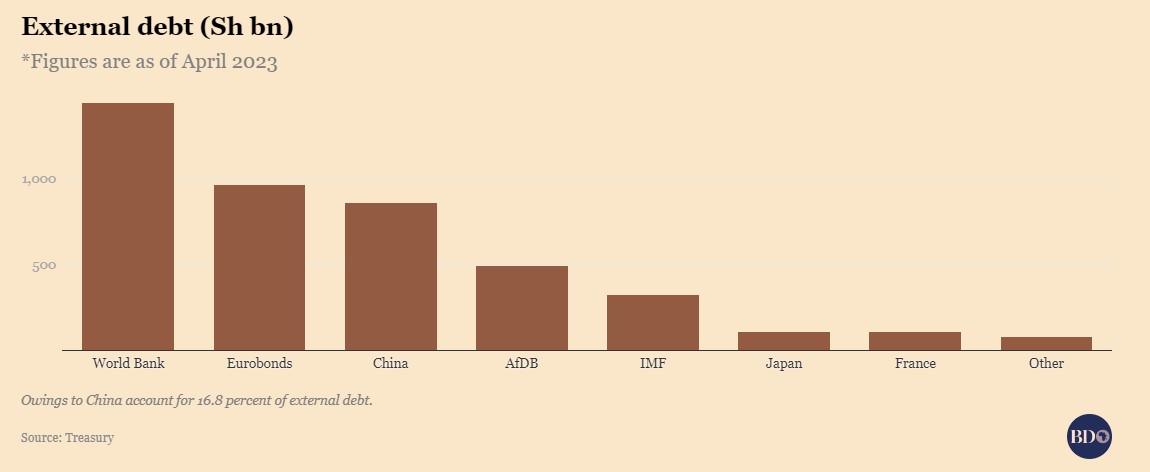

Why is this happening with the current regime, you ask? The government has obligations that it is supposed to meet. Kenya has international debts to repay and development projects to work on. In the fiscal year 2021/2022, government spending in Kenya totaled nearly 3.02 trillion Kenya shillings. The amount consisted of interest payments, salaries and wages, pensions, and costs for maintenance and operations.

.jpeg)

But before we proceed, let’s understand what it means when a country declares Bankruptcy.

Did you read this?

Bankruptcy is a legal proceeding initiated when a person or business cannot repay outstanding debts or obligations. It offers a fresh start for people who can no longer afford to pay their bills.

For ordinary people, Bankruptcy means higher food costs from inflation, as the government prints money to cover its costs. It means unemployment; as businesses and government agencies cut spending, it also reduces essential services such as health care and education. All this increases political pressure on a government to resolve the default as rapidly as possible.

A country cannot simply declare Bankruptcy as a private business might. Instead, the government needs to start a restructuring process, which means renegotiating the contract terms of its debt with all its creditors, individuals, groups, or even countries.

One of the first steps is usually to call in the International Monetary Fund, which works with the World Bank and government to agree on a plan to help the country get its finances working again, often providing emergency funding. This is often a difficult negotiation in itself. Then, the government needs to get agreement from all its creditors on the basic plan.

They might have to agree to receive their money back over a more extended period or write off some of their loans to reduce the overall amount owed. However, agreeing to such a restructuring plan has become increasingly complicated in recent years.

It is good to note that there are different levels of a country being broke. The first definition is basic: When your revenue is insufficient to cover your expenses. Kenya has had a consistent budget deficit. Between 2013 and 2022, our average expenditure exceeded our revenue by 40%. For example, revenue from July to December was Ksh.1.1 trillion, with expenditures of Ksh.1.468 trillion.

Kenya will borrow Ksh.700 billion this fiscal year to cover the deficit. We need to fill a Ksh.800 billion gap in the current fiscal year, which ends in June 2024. In this definition, Kenya is unquestionably at the point where our revenue does not equal our expenses.

The next step is insolvency. This is when a country is unable to pay the debts owed. At this point, revenues are insufficient to cover expenses, and the difference cannot be borrowed. This could be because a country is considered too risky to lend to. International markets say we will lend money, but at a higher rate or not lend at all. Furthermore, the country’s reserves would be too low to pay what it owes. But we can safely say Kenya is not at this point because the country’s borrowing rate has increased.

In conclusion,

- Is Kenya broke? Yes, our revenues/earnings are not enough to meet our needs.

- Is Kenya insolvent? No, we have not defaulted on our external debt payments. Yet.

- Do we have a cash crisis? Yes, considering salaries for some civil servants have been delayed, and we have not paid pending bills for years.

- So, are we heading to Bankruptcy? It depends on who you ask.

- Is it a liquidity management issue? Let us know your thoughts in the comment section.